Your budget is important. It also needs to include everything on which you spend money. Have you forgotten to add anything to yours? Learn the top items most people don’t remember to add to their budget.

It’s no secret you need a budget, but if you’ve left off some essential items, it’s not going to do you much good. After all, if you have to spend more than you plan, then your budget is a worthless piece of paper or an app taking up memory on your phone.

The problem is not that you intentionally left them off. More than likely, that hey were overlooked Here are ten items you might find are missing from your budget.

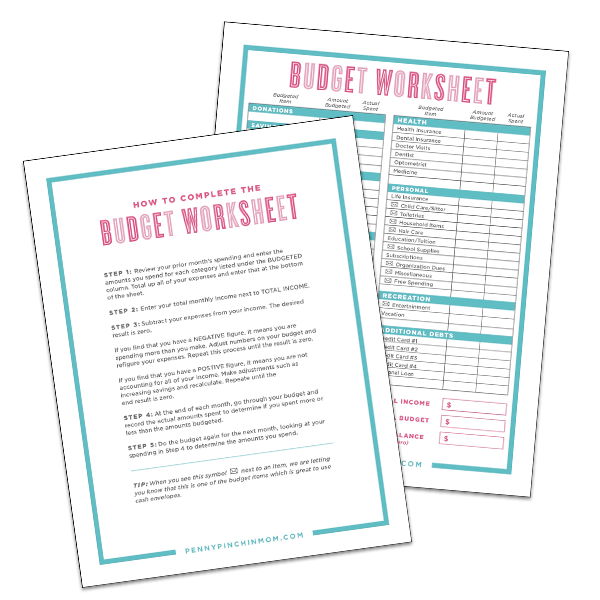

If you don’t yet have a budget, make sure you grab our free printable budget form to get started!

ITEMS YOU FORGOT TO PUT ON YOUR BUDGET

1. SUBSCRIPTIONS/MEMBERSHIPS

If you happen to belong to Amazon Prime, you have an annual membership fee of $99. You should include that and other memberships and subscriptions like magazines, gym memberships, etc. Determine the monthly cost (divide the total by 12) and make sure you are saving that amount every month.

2. CLOTHING

As a parent, I never forget that my kids need clothes. However, it is easy to forget about my own needs. If you’re like me, you’ll want to remind yourself and account for necessities like undergarments and socks in your budget. And try to prepare for unexpected items as well. As soon as you buy a new pair of sneakers for your oldest, your youngest will suddenly hit a growth spurt, and you’ll be out shopping for him too.

To determine the amount to save, look at your total spending over the past 12 to 18 months. That will give you an idea of what you spend annually and how much you may need to pay for the expenses this year. Always make your deposit of this amount your cash envelope.

Read More: How to Create and Use The Cash Envelope System

3. SPECIAL OCCASIONS

Holidays, anniversaries and birthdays….they come around again every single year, so make sure to include them in your budget. You will also want to look ahead for one-time events like a wedding (which may require travel costs as well as a gift).

To determine the amount to save, take a look at what you spent the prior year. Then, divide the total paid by 12 to get a monthly budget amount.

4. FUN MONEY

You work hard for your money, so you should treat yourself to something special now and then. It might mean a latte on the way to work or even that new book you’ve wanted to read.

Don’t suffocate under the stress of your budget. Allow some room to have a little fun every now and again. When you do, you will find it easier to stay on budget with your other expenses.

5. PET EXPENSES

Don’t forget to include the four-legged family members. Your pet needs food. He or she may need grooming monthly. There are also annual visits to your vet along with vaccinations.

You may also need to board your pet during your family vacation. Just add in a “PET” line to your budget, so you aren’t caught having to cover expenses above the budget.

Read More: How to Save Money on Your Pets

6. IRREGULAR BILLS

There may be bills which come around quarterly or annually. Make sure to include these in your budget. Use the simple formula of dividing the total you owe by 12 to reach the amount to set aside each month.

Read More: How to Create a Budget with Irregular Income

7. VEHICLE MAINTENANCE

You probably remembered your monthly car payment, but did you add in fuel costs? What about oil changes and new tires? It is a simple item to forget about, but always budget for the routine maintenance needed to keep your car running.

8. HOME MAINTENANCE

Each spring you know you will replace the mulch in the garden. When winter rolls around, you will get the furnace serviced to ensure it works correctly. Are these items in your budget? It is essential to plan for the home maintenance expenses you know about as well as those that will creep up when you least expect them.

9. VACATIONS

If you plan on taking a vacation, it is vital that you include it in your budget. The amount should take into account fuel, hotel, food, venues, etc.

Read More: Brilliant Vacation Money Saving Tips

10. MEDICAL EXPENSES

You know that you have to pay for your insurance. You may even have a savings plan at work to help cover the out-of-pocket expenses. But, what about the items that may not be covered? Do you need new glasses? Is your monthly medication covered? Make sure you are setting money aside each month to pay for these.

Your budget is your roadmap to financial success. There are bound to be some detours, but if you can plan, you can make sure you follow an alternative track and still achieve your goals.