INSIDE: Need help knowing how to budget? This step-by-step guide will help you create a budget that actually works. Includes free printable budget spreadsheet template!

This post may contain affiliate links. That means if you click and buy, we may receive a small commission. Please see our full disclosure policy for details.

When you’re trying to pay off credit card debt or save money, you’ll hear it time and again: “You need a budget.” But if you’ve never created a budget, the mere thought may make you want to run and hide. Making a spending plan that works is not hard, however, if you have someone to help you.

If you’re ready, I can help. Below you’ll find step-by-step instructions to follow to create your budget, whether you’re a beginner or have budgeted in the past.

You can use a pen and paper with our printable form or software for online budgeting.

Improving your money management skills doesn’t just mean spending less. It also means learning about your spending habits and making changes.

A few tweaks may help you pay off your debt and reach long term goals, such as saving for retirement.

MY BUDGET JOURNEY

I know it can be terrifying to really look at how you spend your money. Trust me, I’ve been in your shoes. But I’ve learned that the things that were the most challenging in my life have led to the biggest rewards.

Declaring bankruptcy was a low point for me. But it also taught me many valuable lessons about personal finance. Most importantly, I learned why I must have a budget.

My husband and I used to have a “bare bones budget.” Except it wasn’t, really. Rather, it was a piece of paper where I’d write down who I had to pay every month, so I didn’t forget.

When we began our journey to become debt-free, we had to look at all aspects of our finances. One thing we did was sit down together to create a budget.

Seeing our expenses and income in writing for the first time still sticks with me. I remember being in tears. It was shocking to see that we had not been in better control of our money.

Creating a budget made us acknowledge where we were, and we realized that we didn’t like what we saw. It instantly provided us with a goal: We wanted to make positive changes and get out of debt. It took time, but we did achieve our goal (and that was one of the best moments of my life).

I am going to be blunt here. Creating your first budget and managing your money with it will bring significant challenges your way.

But I can guarantee that it will be worth it in the end. Just wait until you can finally control where your money goes instead of the other way around. It is liberating.

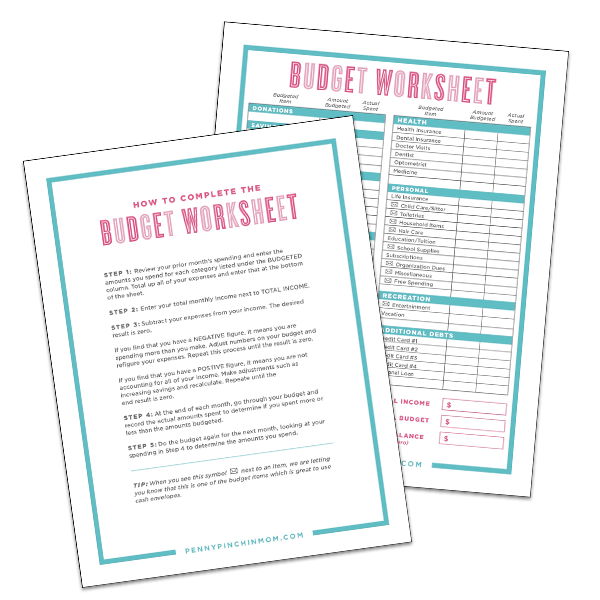

Before we begin, you can download our free budget form by clicking on the pink box below.

If you want something more high-tech, I recommend You Need A Budget (YNAB) or EveryDollar. These are apps I’ve tested and reviewed. Both work very well, so I’m confident recommending them to you.

WHAT IS A BUDGET?

A budget is a plan that lists your estimated income and expenses for a specific period of time. Most people use a monthly budget period. Budgets are helpful for everyone, no matter what your financial situation is.

Tracking your spending in the past helps you predict your future cash flow so you can start saving more.

Also see: 10 Must-Know Personal Finance Tips for Mom’s Financial Success

WHAT SHOULD BE INCLUDED IN A BUDGET?

It’s important to include every dollar you earn and spend when making a budget. Tracking your income is easy, but your budget should also include spending categories. Some you need to remember to use include:

- Savings

- Mortgage or rent

- Insurance

- Utilities

- Car payment or other transportation

- Food

- Clothes

- Child care

- Medical/dental

- Holidays/birthdays

- Subscriptions, such as a gym membership

- Credit card debt

Your list may include more categories or fewer. Our budget template includes categories that will cover just about anyone.

Read more: The categories you need to include in your budget

HOW TO CREATE YOUR BUDGET

Now that you have your categories, it’s time to start filling in the numbers. Follow these instructions to prepare your budget.

Step 1: Gather the Necessary Papers

Before you begin, be sure you have all the things you’ll need. These include (but are not limited to):

- Bank statements, including debit card payments

- Pay stubs

- Credit card statements

- Utility bills

- Monthly bills from various stores

- Personal/vehicle loan information

Step 2: Calculate Your Income

Next, look at your pay stub(s). Your budget should reflect your monthly income. If your paychecks come more frequently than once a month, some simple calculations are necessary to come up with an accurate monthly income.

Here are some formulas to help you:

- If you’re paid biweekly (i.e., every other Friday), add four pay stubs and divide by two to get your average monthly income.

- For monthly pay, you can use the income you see if the amount listed for each pay period is the same. Otherwise, add three or four months’ worth of income and divide by the same number of months.

- If you’re paid weekly, take the total of four income periods.

- Here are some tips for families to thrive when living on a weekly budget

- When you’re paid hourly or on commission (i.e., your income fluctuates), add your last four months of salary and divide by four to reach an average. If your income varies frequently, you’ll need to adjust your budget more often than someone with a regular income. You may also want to follow our tips for creating a budget with irregular income.

Also see: How to budget money on a low income

Step 3: Determine Fixed Expenses

You must make certain payments, such as your mortgage or rent, insurance premiums and car payments, on a regular basis. These recurring expenses are usually a fixed amount.

If your bill varies slightly each month (for instance, if your utilities aren’t on a budget billing system), take the past three months’ worth of statements and average them to get your estimated payment.

You can use a spending form to figure out the exact amounts to include in your budget. For example, say your October gas bill is $45.79, your November bill is $52.95, and your December bill is $49.22.

Add those three numbers and divide by three to reach your average (in this case, $49.32). I recommend you look at the months when your utility bills are the highest. For instance, you may use more gas or oil in the winter, so use those months as the basis for your budget.

One of the most important rules of personal finance is to pay yourself first. Do this by adding categories for saving. You need to save for a rainy day as well as for long term goals, such as college or retirement.

You can set up automatic transfers each month from your checking account to a savings account for your emergency fund (aim to build up at least three months’ worth of living expenses). If you have a retirement plan at work, such as a 401(k), your money is automatically withdrawn from each paycheck before you get it.

Step 4: Calculate Discretionary Expenses

Your discretionary expenses include those that vary more, such as food, gasoline and clothes. Treat them the same way you treated the gas bills described in step 3. Make sure you take the average of three months’ spending to get the figures to add to your budget.

Be sure to include occasional expenses, such as car repairs and maintenance. The goal is to pay these bills with your regular income instead of running up credit card bills.

Step 5: Fill in the Numbers

Transfer the figures you’ve calculated above to the appropriate spots on the budget form or spreadsheet. Put your monthly income at the top, followed by the amounts for each expense category.

The categories listed on our form are a guide for tracking your spending. You can add categories that aren’t included or ignore the categories you don’t need.

Add all your income and all your expenses. Then subtract your expenses from your income. The result should be zero. If it’s not, then figure out the changes you need to make.

- If your total is a negative number: You’re spending more than you earn. Reduce your spending until the total reaches zero.

- If your total is a positive number: You haven’t spent everything you make. Either increase your debt payments or your savings.

Also see: Family budgeting 101

FINE-TUNE YOUR BUDGET

After you complete your budget for the first time, you may feel discouraged. As mentioned above, it happened to us. But once we started to rework the numbers, I began to feel better. I began to feel like I could live with a budget. It was tough, but nothing in life worth having is easy!

To balance your budget, first look at your fixed expenses. One I always like to mention is cable. We found out we were paying way too much and found a way to cut the expense in half. (As much as we would like to cut the cord entirely, we’re not yet there.)

Perhaps you could do the same and sign up for a lower-cost cable plan to free up some income. There are many other ways to reduce your monthly expenses, such as reshopping your insurance or refinancing your mortgage.

Once you’ve cut back your fixed expenses, it’s time to look at your discretionary spending. Perhaps you’re eating out a bit too much, so your budget takes a hit. You may even be overspending on shoes. These are areas where you might need to scale back to balance your budget.

Also see: Managing Family Finances: Tips and Strategies for a Better Financial Future

Making these decisions isn’t fun, but consider what is more important: paying off debt or buying a bigger television. These are choices only you can make. But if you’re willing to scale back now and pay off debt, it will be worth it when you can buy that new TV or those new shoes without guilt!

If you’ve scaled back on everything you can and your budget still doesn’t balance, make some calls to your debtors. Ask for a reduced interest rate or a lower minimum payment on your credit cards. You never know what they will accept until you make those phone calls.

My husband and I wanted to get out of debt, so we decided that we wouldn’t eat out as often. For more than two years, we ate dinner out no more than 10 to 20 times a year. We saved a lot of money, which we used to pay off debt. It was challenging, but the result was well worth the temporary sacrifice.

WHAT TO DO ONCE YOU HAVE A BUDGET

First of all – congrats! You now have a budget you can use. You should revisit and update your budget at the end of each month.

After a few months, you probably won’t need to make any changes. But if you get a raise, have an added expense or finally pay off your car, that will require a shift in your budget numbers. Remember that your budget must always end in zero!

Creating a budget isn’t easy, but once you have one set up and continue to refer to it, it will pay off. You’ll find it helps because you are now telling your money where you want it to go rather than it telling you where it is going each month. Financial control is a fantastic feeling.